Process Case Study: Crown Castle (CCI)

Step 1. Identifying a Long-term Inexorable Trend

Wherever possible, we prefer investments that benefit from an inexorable trend – the sort of long-term trend that cannot be disrupted by geopolitics, elections, pandemics, wars, etc., the sort of trend that we can be confident will continue for decades into the future, and the sort of trend where we may be wrong in magnitude, but where we are very unlikely to be wrong in direction.

For Crown Castle, the inexorable trend we identified is increasing data consumption in the world, and more specifically, increasing mobile data consumption. This inexorable trend has been around for a number of years but only recently has its growth gone into overdrive driven by mobile phone handset improvements, higher capacity networks (3G to 4G and now 5G) and the massive growth in online streaming video consumption. Going forward, this growth will continue to be magnified by the Internet of Things (IoT) and the automation of vehicles.

In short, we will be using more data 3, 5, 10 years from now than we are using today. We simply cannot imagine a world where this is not true. It does not require any intellectual brilliance on our part to see this, but it does require a little ingenuity to profit from it.

Step 2. Understanding the Value Chain

Once we have identified an inexorable trend and have conducted sufficient research and analysis such that we are confident in its duration, stability, resilience and size, the next stage is to understand the economic implications of the trend.

To do this, we need to start with the value chain – which industries and companies will benefit from the trend, what are the inputs, outputs, and processes, and how will profits ultimately be distributed. The key is to find the sweet spot in the value chain where the most value will flow with the least amount of uncertainty or risk. At the same time, it is also worth considering where the value will flow away from as there will always be some companies and some industries on the wrong side of an inexorable trend that will end up losing out. Just think of VHS when DVD’s were invented, and then DVDs when internet streaming became prevalent.

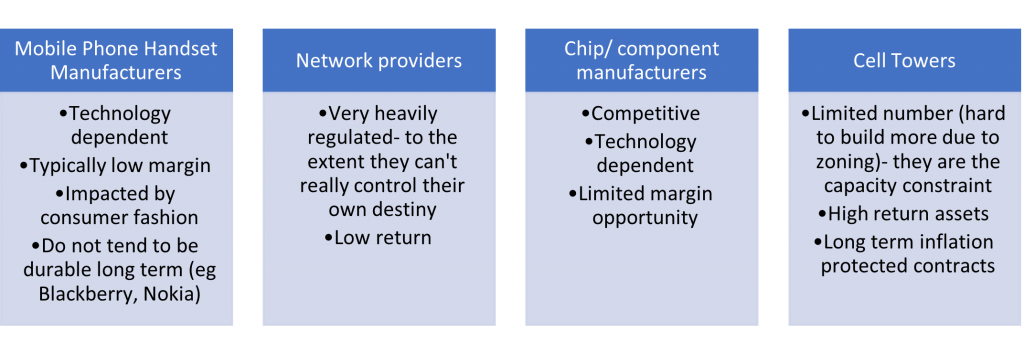

For our mobile data consumption inexorable trend, we have outlined below three key areas of the value chain that investors might consider for possible investment along with a few very high level considerations for each:

Whilst there are many areas that investors could choose to target to take exposure to this long-term trend, and arguably many areas that will benefit, the cell towers stand out as a key bottleneck that will benefit most with the least amount of risk involved.

Whilst there are many areas that investors could choose to target to take exposure to this long-term trend, and arguably many areas that will benefit, the cell towers stand out as a key bottleneck that will benefit most with the least amount of risk involved.

The cell tower business is fundamentally a simple one that our clients will be familiar with due to our longstanding ownership of American Tower (AMT). The tower companies own a small parcel of land (or rent it) on which they build a simple 200-300ft steel structure. On that structure, they rent space to carriers (AT&T, Verizon, T-Mobile, etc.) who need to place equipment to carry mobile signals.

All the equipment is owned by the carrier, the tower company just rents space on the tower. They do so typically through very long- term contracts (15yrs+) which often contain either fixed annual price escalations, or alternatively inflation linked escalations. Switching costs for customers are incredibly high, the yields on the simple steel structures are substantial, especially as additional tenants are added, and as a result, the tower companies produce a great deal of cash every year.

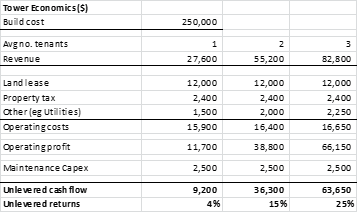

The cash they must reinvest in maintaining these steel structures is miniscule – keep the structure standing, mow the grass at the bottom, and that’s basically it. As zoning for new towers is so hard to get, each existing tower becomes an increasingly valuable asset. The uncertainty here is low – we as shareholders can see the future returns with a very high degree of confidence given the contractual nature of the revenues. The actual economics look something like this:

Now, the reason these cell towers exist as the bottleneck in our trend is because there are simply not enough macro cell towers in the US to deliver the huge amount of data that is going to be demanded going forward. It’s easy to make more mobile phones, more chips, etc., but it is incredibly hard to build any new cell towers, as zoning laws are extremely strict regarding 300ft steel towers that may or may not contribute to various health concerns. All these points combine to make cell towers the key constraint and limiting factor in our ability as a society to consume more mobile data.

And not only do the cell towers have amazing economics, long-term customer contracts, highly visible revenue, rational competition, unregulated fixed assets, and huge barriers to entry, but there also only happens to be three major cell tower players in the United States which further narrows the investable universe.

Step 3. Choosing Which Companies to Focus On

We are often asked how a reasonably small investment team can compete with the huge banks when it comes to equity research- how can we possibly analyze thousands of companies? The simple truth is that when investing thoughtfully and carefully, there is no need to analyze lots of companies. Once we have gone through the work to identify the long-term trend and where in the value chain to best position ourselves, we have already stacked the odds in our favor and have already narrowed our investment universe. Think of this like choosing a restaurant – if you go to an excellent restaurant, it does not really matter what you order, the food is going to be excellent. In a similar way, if we get the long-term trend and value chain analysis correct, we have got a much higher chance of success when it comes to the individual companies.

In this case, we’ve narrowed our investable field to just three companies. The next stage is that we now need to pick one (or in this case two) of those three. For an industry like the cell towers, all three of the dominant players here arguably stand to generate good investment returns over the next 5 to 10 years, but for different reasons. The similarities lie in the underlying tower economics, which are reassuringly excellent and for all three provide a huge amount of free cash flow every year. The differences come in terms of how each company looks to reinvest those cash flows. Here each is taking a very different strategy:

- SBAC: The smallest of the three. They are typically taking the huge cash generation and using a lot of it to simply buy back their own stock. A great strategy for boosting returns, but we would ideally like to see cash reinvested at high rates into strategies and assets that will produce more cash in the future.

- AMT: They are taking the cash produced from their large tower portfolio in the US and using it to acquire banks of towers in emerging markets. In exactly the same way the US market grew 15-20 years ago, much of the emerging markets infrastructure has been built out by the carriers themselves, who then over time realize its more capital efficient to sell their towers to tower companies such as AMT. So, effectively AMT is replicating the exact same strategy they did in the US 15-20 years ago but in international markets. It’s a fantastic strategy – they have the experience and a detailed playbook of how to do this and are able to reinvest their cash at substantial return levels. As you know, we already hold AMT for this reason.

- CCI: Here the company is taking the cash produced and investing it all within the US, into a new market area called ‘small cells’. These are effectively mini towers that are used in dense urban areas to provide more network capacity for the shift to 5G. They are small units that fit onto traffic lights, lamp posts, etc. This is a market that didn’t even exist 5 years ago, so there is still some uncertainty around long term returns, but so far the results have been good and there is clear line of sight to substantial growth in the need for small cells within large metro areas in the US. CCI’s strategy has taken us more time to get comfortable with, but we believe it has huge potential over the long run.

So, in a similar way to our value chain analysis, we narrowed our field down even further, such that we only really see AMT and CCI as investment candidates in the space.

Step 4. Analyzing the Shortlist with Real Intrinsic Value Recognition (RIVR)

Once we have narrowed down our shortlist, we can then begin trying to answer the two questions at the heart of our process:

- Is this a high-quality company?

- Is it trading at an attractive price?

Obviously, our earlier analysis has already begun to answer some of the questions around quality here, but there is still some more work to do. For this example, we will be referring to our new position in CCI but a lot of this is true for AMT as well. (Once again – efficiency of workload, a lot of this work in understanding one company is very applicable to the other).

Step 4.1. Is CCI a High-Quality Company?

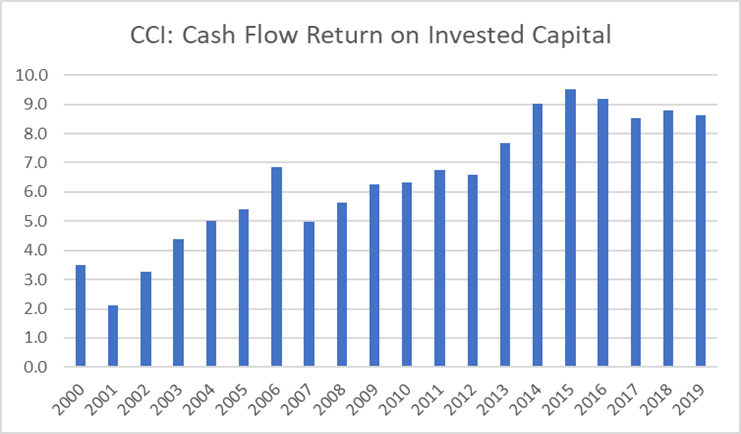

Firstly, it is reasonably quick and easy to determine that CCI has displayed a high-quality history, as the industry would define it. This business has generated extremely consistent cash returns on capital:

Source: Factset

Source: Factset

Two obvious next questions are:

- Is there a moat/competitive advantage in the legacy business to ensure that CCI can continue earning these returns into the future?

- Is there a market runway to ensure that these cash flows can be reinvested at high rates into the future?

Regarding moat/competitive advantage, the tower companies are blessed with a considerable moat, stemming from two main areas:

- Asset scarcity (driven by regulation): it is incredibly hard to build new towers due to zoning laws, so the assets they have are very valuable.

- Switching costs: even where there is overlap in coverage with other pre-existing towers (perhaps those of AMT or SBAC) the switching costs for network carriers are high. Firstly, they would have to buy out of what are long term contracts (15yrs+), they risk service disruption, and there is a physical cost to move equipment from one site to another. For those reasons, there is incredible customer retention.

As such, the historic returns that have been achieved by the macro tower business are highly likely to continue. In addition to this, the rollout of 5G technology could result in an improvement of returns still further. Shifting from 3G to 4G was simply a software upgrade, carriers did not need any new hardware. Moving to 5G requires new hardware, such that new contracts will need to be signed with the tower companies. These new contracts provide the opportunity for a step up in pricing and will typically lock customers in for another 15 years.

So, we can be confident that not only has the business been high quality in the past, but that it will continue to be so well into the future.

But it is not necessarily true that this attractive macro tower market has a big growth runway for reinvestment, as much of the U.S. has already been saturated with Macro Cell Towers. Instead, we must look at where CCI is reinvesting their cash: the small cell marketplace. There are several points to consider:

- The market is growing very quickly: currently there are 200,000 small cells in the US, growing at over 30% per year. CCI is currently around 35% of the total.

- Investment yields for CCI start at around 7-8% for one tenant, but once the deployments mature and they add more tenants, the returns rise above 15% (evidenced by some of their earliest build outs such as in Orlando).

- Contract structures are also often 5-15yrs providing significant customer stability.

Overall, we can see that there is a path to small cells not only returning similar levels to the macro tower business, but potentially even higher over the long term. When it comes to the competitive advantage or moat, it looks a little different when compared with the legacy business. Small cells need to run on a fiber network, meaning they need fiber optic lines and cables underground to be able to operate. It is this fiber backbone that provides much of the moat.

Many carriers have fiber networks themselves, and where they do, they will likely build their own small cells in order to make use of their fiber (they are already doing so in some areas). But CCI is betting on the carriers realizing (as they did with the Macro Towers) that it is more efficient to rent shared infrastructure form a third party than each carrier building it out themselves, plus there are many areas where carriers don’t have sufficient fiber assets themselves. As such, CCI have been aggressively buying fiber assets over the last five years, and they now own roughly 80,000 miles of fiber optic cable across the US, concentrated in 30 of the largest metro areas. In addition they are continually reinvesting cash flows by building and extending these networks.

We believe it is this fiber backbone (which would be uneconomical to recreate) which will provide the main moat for CCI’s small cell business going forward.

Step 4.2. Is CCI Trading at An Attractive Price?

Given the long-term nature of CCI’s contracts, and the huge visibility around its underlying demand driver, it would be fair to expect that the market would do a reasonable job of valuing CCI as a company. However, as always, the market takes too short term a view and does not give CCI credit for the huge potential value they can create by building out small cells on their fiber network.

There is currently a lot of negative commentary about the $14bn that CCI has spent acquiring fiber assets, with the negativity focusing on the admittedly low level of returns they currently achieve on that $14bn. But looking at the current returns here totally misses the point – CCI are only at the very beginning of monetizing this investment in fiber miles. The market (as it often does) is making the mistake of looking at current returns on the fiber network, and isn’t looking far enough out to see the returns they’ll generate from all of those fiber miles in 5, 10, and 15 years – once they’ve built out a substantial small cell network on that fiber backbone.

The way we approach valuing CCI is effectively as two businesses: the existing legacy macro tower business, and the newer small cell business. Valuing the existing business is a fairly simple process using a DCF (discounted cash flow) approach given the stability of returns and the certainty of future cashflows given the contractual nature of the revenue stream. Without getting into minute detail, we reach a value of around $84bn for the traditional macro tower business.

When it comes to valuing the small cell business, the factors to consider in forecasting future cash flows are as follows:

- The amount of fiber they have already, plus more that they will buy/ build

- The ultimate yields they can achieve on the fiber investments. Based predominantly on:

- Number of tenants per small cell

- Number of small cells per mile of fiber

- The pricing environment for small cells

Each of these elements has less certainty than the existing business, but given what we regard as conservative assumptions for the future returns based on their existing small cell deployments, we estimate that the small cell business is worth at least $30bn at today’s values (with significant upside potential).

Putting all that together gives a combined enterprise value of at least $114bn. Given that the company has debt of $24bn (very serviceable given their secure revenue streams), the value of the business should be around $90bn. This works out at around $215-220 per share. We began buying shares in the market for under $160 per share. That gives a 10-year IRR (internal rate of return) of above 9% on share price alone, and as a shareholder you also receive a 3%+ dividend yield, so we should expect a total shareholder return (TSR) of roughly 12%+ for many years. More importantly, we can be confident in this return potential being durable well into the future, despite what the stock price might do in the short- run.

For us thinking about constructing the portfolio, we consider the tradeoff between our expected returns and the risk profile of the investment, compared to those already within the portfolio. Here we determined CCI would be an efficient allocation of capital. This is not always the case, and we have many stocks we would love to own but where valuation is too high to provide us with an attractive IRR, so we simply wait patiently until the market provides us with an opportunity. This is what disciplined investing is all about.

Disclosures: This website is for informational purposes only and does not constitute an offer to provide advisory or other services by Globescan in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction. The information contained on this website should not be construed as financial or investment advice on any subject matter and statements contained herein are the opinions of Globescan and are not to be construed as guarantees, warranties or predictions of future events, portfolio allocations, portfolio results, investment returns, or other outcomes. Viewers of this website should not assume that all recommendations will be profitable, or that future investment and/or portfolio performance will be profitable or favorable. Globescan expressly disclaims all liability in respect to actions taken based on any or all of the information on this website.

There are links to third-party websites on the internet contained in this website. We provide these links because we believe these websites contain information that might be useful, interesting and or helpful to your professional activities. Globescan has no affiliation or agreement with any linked website. The fact that we provide links to these websites does not mean that we endorse the owner or operator of the respective website or any products or services offered through these sites. We cannot and do not review or endorse or approve the information in these websites, nor does Globescan warrant that a linked site will be free of computer viruses or other harmful code that can impact your computer or other web-access device. The linked sites are not under the control of Globescan, and we are not responsible for the contents of any linked site or any link contained in a linked site. By using this web site to search for or link to another site, you agree and understand that such use is at your own risk.