GCI: Year-End Portfolio Review 2019

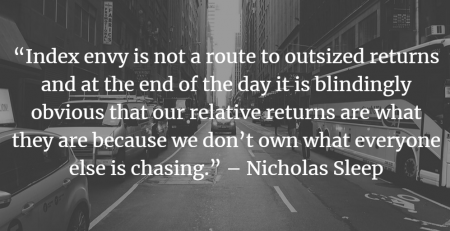

As you know, we run an active, concentrated portfolio. We believe that the best way to maximize long-term wealth is by owning high-quality companies that we can purchase at a discount to their intrinsic value. We also believe that it is less risky for an investor to own 25 stocks which they know inside and out than to own 500 stocks (passive index) which they know very little about.

When we construct a portfolio, we want to concentrate capital in our best ideas – where the risk/ reward tradeoff is most attractive. There is no sense in diluting 25 great opportunities with 25 average ones. The reason many investment advisors do so is that possibly they themselves are either unqualified or unwilling to do the due diligence required to separate great investments from average ones, or more frequently, they are simply unwilling to expose their own reputation to make that judgment.

As we end this year and move onto the next, we want to provide you with some more detail on how your portfolio is constructed, and why it looks the way it does. In the end, we know that you could invest in an index or passive product at very low fees and generate average returns. However, you choose to remain with us because you believe our investment strategy will provide above-average returns over the long run. We want to reassure you that you’ve made the right choice.

Your Portfolio vs. Passive Trackers

A simple way to think about how good a portfolio is (or isn’t) is to compare it to a broad index. As passive investing has become the norm, this is effectively now a question of “how does my portfolio compare to the average investor’s portfolio?”

The two most widely used indices are the S&P 500 and the Dow Jones Industrial Average. A quick note on using indices such as these for comparison:

- S&P 500 – This is a market capitalization (company size) weighted index comprised of the largest 500 US stocks. It is not necessarily representative of the economy, nor is it balanced. For instance, the sectors ‘IT’ and ‘Communication Services’ together account for more than a third of the total index- and bear in mind that ‘Communication Services’ is a new sector that was created to obscure how large ‘IT’ had grown. The stocks remained the same, some have just been re-allocated to this new sector.

- Dow Jones Industrial Average – This is a hand-selected group of 30 companies that are chosen to represent the economy overall. As a measurement tool, it is very widely used, despite being largely meaningless. This is because it is a ‘price-weighted’ index: meaning the index level is the sum of all the stock prices of the underlying companies. A company worth $1bn with 1bn shares would have a stock price of $1, a company worth $1bn with only 1m shares would have a price of $1000, and therefore have 1000x more of an influence on the index. That as a construct is clearly absurd and not helpful.

Right off the bat, both indices have their issues – which is why passively investing can be so risky. But that being said, let’s compare your portfolio to that of the ‘average investor’.

(Note- the following analysis is ex. financials and REITS as their different accounting standards skew the calculations. Furthermore, a company’s reported financials can deviate far from their true economic situation (i.e. CarMax is required to report its leverage as 17x, when their true economic leverage is closer to 2x). We have adjusted for some of these discrepancies in our portfolio, but they remain in the index’s numbers.)

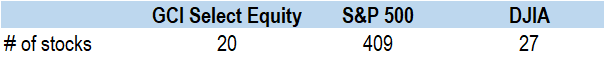

CONCENTRATION

Your portfolio is more concentrated than average. We don’t dilute your portfolio with unexceptional companies, choosing instead to avoid some industries with poor economics altogether.

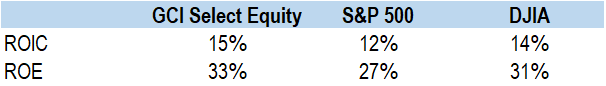

RETURNS

Your portfolio generates higher returns on capital than average. Over the long run, a stock’s performance will be determined by the returns they generate on capital (ROIC). Furthermore, we focus on companies where those returns are protected by wide competitive moats.

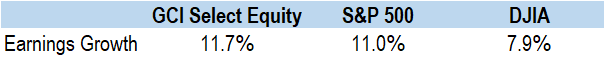

GROWTH

Your portfolio is growing earnings faster than average. Which when paired with higher incremental returns on capital, results in superior compounded returns.

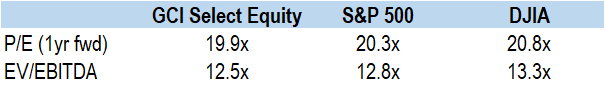

VALUATION

Your portfolio is cheaper than average. Your portfolio is concentrated in stocks that are not only growing faster, with higher returns than the market, but which we also feel are trading at discounts to their intrinsic value (we have written about the folly of multiples, preferring the use of a full DCF, but these multiples are presented for simplicity).

The basic takeaway is that your portfolio is positioned attractively relative to the average portfolio a passive investor would have. That said, these numbers, though simple and straight forward, tell us little about the true quality of our portfolio. They don’t tell us whether the companies we own are at risk of disruption, or if the market opportunity they seek to execute on is growing or shrinking over the long run. For that, we need to do the hard and fundamental work of analyzing each company individually – which we will talk about next.

What Matters Most: Understanding the Companies You Own

The best way to think about the quality of a portfolio is to understand the individual companies that make it up. Said another way, the best way to control risk is by knowing what it is that you own inside and out. As such, we would like to provide you with a brief summary of the investment case for our ten largest holdings:

MASTERCARD

Mastercard is a tollbooth business – collecting a fee on electronic payments regardless of whether those payments are credit, debit, online, mobile, etc. Their position in the market is extremely well protected due to a very difficult chicken and egg problem that would-be competitors would need to solve – issuers want to issue cards that consumers want to use, consumers want to use cards that merchants accept, and merchants want to accept cards that issuers issue. This creates a powerful network effect as the more of each party on the network, the more convenience, the more data, the more secure, the better the overall network is for everyone, which explains why only a handful of networks have come to dominate the market over time.

Going forward, Mastercard’s earnings growth will be driven by the continued secular trend away from cash-based payments – a trend magnified by the inexorable shift towards e-commerce (growing 4-5x the rate of face-to-face transactions), and the increasing ease in which Merchants can access Mastercard’s network (mobile payments, browser payments, smart speaker payments, IoT payments, etc). We believe that the market is failing to price in the likely step up in growth these trends will bring Mastercard, probably due to continued worries relating to disruption risks (Bitcoin, FinTech, Regulatory) which we do not believe are justified over the medium-term.

ALPHABET

Google’s core business is search advertising, where AdWords has proven to be one of the best businesses of all time – when you hear companies talk about customer acquisition costs, what they are really talking about is paying their toll to Google. Google’s position as the dominant tollbooth between customers and businesses wanting to reach those customers is extremely well protected due to the network effects involved in search engines, and the data feedback loop that makes those search engines better over time.

That incredible business has allowed Google to aggressively expand into many other industries – email, hardware, cloud computing, mapping, autonomous driving, etc. The acquisitions of YouTube, DoubleClick, and Android have proven very lucrative for shareholders, and as such we have grown comfortable with the way management allocates our capital. If at any time, however, management chooses to dial back those investments, the amount of cash that could be returned to shareholders would be far in excess of what today’s financial statements would suggest.

We believe that the recent regulatory worries regarding anti-trust are unwarranted. For one, the service Google provides is extremely valuable to end-users and happens to be free. Two, if Google was broken up, it would probably increase Google’s total market value, an unintuitive outcome that is due to something known as the conglomerate discount (for example, YouTube’s growth might be masked by other slower growth segments, AdWords margins might be masked by other lower-margin segments, etc).

Going forward, Google’s growth will be a function of the time people spend online – a secular trend that we believe is in our favor.

EQUINIX

Equinix is a data center operator, structured as a real estate investment trust (REIT). Unlike other wholesale data center operators which provide large amounts of low-tiered commoditized capacity to select customers, Equinix’s key service is offering colocation and interconnection services in which customers pay for traffic exchanged within the data center among carriers, enterprise customers, the public cloud, etc.

The interconnected data center market is fundamentally different from the simple data storage data center marketplace. In interconnections, the most important thing is scale- who are the customers present at each site; the more customers present, the more attractive that site is to other customers. Equinix’s position in this market is very well protected due to powerful structural advantages: they have the most cross-connects and key cloud partners, their data centers gain value as more customers collocate thus increasing the density of the network, and their data centers are positioned in key, scarce metropolitan areas which provide lower latency for latency-sensitive customers. Furthermore, customers face high switching costs since moving a server could disrupt their business, resulting in longer-term contracts that are often renewed. Equinix’s churn rate is sub 3%.

We believe that Equinix’s data center business is still in its early growth stages, driven forward by secular trends in global internet access, e-commerce, IoT, high definition streaming video, and enterprises moving to the cloud, which the market has yet to fully appreciate, possibly due to the companies REIT status.

MICROSOFT

Microsoft is probably best known for its Windows operating system – the dominant computing platform back when everyone still used desktop computers. It might surprise you to learn that Windows is a small portion of Microsoft’s business today, massively overshadowed by their Cloud (Azure) and Productivity Software suite of services (Office).

In the cloud, Azure is well-positioned to gain share in a fast-growing, massive market opportunity where they are a more natural partner for enterprise customers compared to the current market leader, Amazon’s AWS. In productivity, Office remains one of the best businesses of all time on a stand-alone basis and looks even better when we realize Microsoft can leverage their massive installed base as a touchpoint for an Azure move.

Putting everything together, and we are looking at a $1T mission-critical company that is growing faster than many smaller companies and doing so with tremendous operating leverage. While Microsoft may look expensive relative to it’s past, their market opportunity and growth rates far outpace historical comps and the company should be able to deliver at least mid-to-high teens EPS growth going forward with upside from deploying its $137B cash balance (can play offense in a downturn, pitch consolidation sales, etc), buybacks, and dividends.

WYNDHAM HOTELS & RESORTS

Wyndham is a franchiser of economy and midscale hotel brands. They currently control roughly 40% of that market, a number that drops down to 10% when we include non-branded independent hotels, which provides Wyndham with a significant runway to continue consolidating the industry – providing scale economies and a pipeline of demand, through their loyalty program, to smaller mom and pop hotels. Wyndham is a recent spinoff from parent Wyndham Worldwide, a situation that tends to result in an underfollowed and undervalued name, which seems to be the case here as Wyndham is trading at a significant discount to closest peer Choice Hotels International Inc.

We believe that the market underappreciates Wyndham’s franchise business model, in which they receive attractive and less economically sensitive royalty fees from hotel owners to use their brand. It effectively means that Wyndham will be able to grow their earnings in most economic environments, due to their embedded pipeline of room count growth. Add to that the cash generative/ capex light profile of the business, and there is plenty of opportunity to buy back shares and further enhance shareholder returns. We believe such a business deserves a higher multiple than the market is currently awarding Wyndham.

AMERICAN TOWER

American Tower is a wonderful example of a company that lies squarely in the middle of a huge, multi-decade trend. This trend is the exponential growth of mobile data consumption driven by increasing smartphone penetration, faster available mobile internet speeds, a huge growth in content (particularly video such as Netflix, Disney+, etc) being consumed on mobile devices, as well as huge growth in the number of internet-enabled devices.

American Tower is one of the largest owners of cell towers in the US. These are incredibly valuable assets, as they are arguably the bottleneck when it comes to us all needing more and more mobile data. It is very hard to build any new towers as zoning is so difficult to achieve. American Tower simply owns the tower and rents space to telco companies to fix their equipment on – a very efficient business model. These towers typically have 10-20-year inflation-linked contracts. The cash flow predictability is exceptional, and American Tower is taking this business and recreating it in faster-growing markets like Brazil and India, providing tremendous growth runway.

This is the sort of trend that is very unlikely to be disrupted- no political party, individual company or country can do much to stop it. Valuation permitting, we could conceivably own American Tower for decades to come.

Facebook is one of the most influential companies over the last decade. They have created the largest social network the world has ever seen. And not only is it large, but it is probably also the most detailed network the world has ever seen as far as their capacity for data collection. Never has one company know so much about so many people. That network as an entity is incredibly valuable- even if conceptually it is very hard to ascribe an actual dollar value to it.

Despite the incredible breadth and depth of their network, Facebook shares were heavily punished during 2018, over a lot of negative press and political pressure. There were substantial concerns that the company would be regulated, split up, or otherwise restricted from being able to monetize their data. Yet Facebook has only just scratched the surface of what they will be able to do with this network over the next decade. Take WhatsApp as an example- it has over 1billion daily active users, and so far, Facebook generates $0 from it. Implement a $1 annual fee for use and it could create almost a billion dollars in cash overnight. Opportunities such as this are abundant across the Facebook ecosystem.

Facebook has been compounding earnings growth at in excess of 50% for the last 5 years. Even if you assume that rate halves going forwards (as a result of more regulation) the stock is still very much underpriced. Such a substantial amount of negative news flow has a powerful sentiment effect on stocks, such that valuable companies can trade beneath their underlying value for considerable periods of time if they are deemed out of favor.

UNITED PARCEL SERVICE

UPS is a great example of a company that is undervalued and underappreciated in the market. UPS is the largest package delivery company in the world, delivering an average of 20 million packages per day across 220 countries. In terms of global networks, it is hard to beat. The opportunity presented to us in UPS stock is that the market is overstating the competitive risks UPS faces. In order to understand why we believe that to be the case, one must look ‘under the hood’ of the main players in this market- UPS, FedEx and now recently- Amazon

Both FedEx and Amazon have grown their delivery businesses very quickly, but they crucially have done so at much lower returns – i.e. they are much less efficient (this is partly estimation regarding Amazon, but the reasoning will become clear in a moment). Why does UPS consistently earn 20%+ returns on capital, whilst FedEx can’t even get to 10%? The answer is that UPS is a totally integrated model- they own everything: ground, air, express, trucks, planes, etc. Both FedEx and Amazon are franchised- meaning they have agreements with franchisees, and as such are restricted in how they can optimize their own routes and services. UPS have total freedom to optimize and structure their operations in whatever way is most efficient- that is a structural advantage that cannot be replicated. And is one that is misunderstood and overlooked by the market.

Despite UPS’s tremendous long- term returns, its huge cash generation (the stock pays a well covered 3%+ dividend yield) it is trading at a discount to the market overall. It is far too easy for journalists or those less well informed to talk about how Amazon is disrupting delivery, without giving fair credit to either the sheer scale of the UPS operation, or how it is fundamentally structured differently, in a far more efficient way.

PERSHING SQUARE HOLDINGS

We are active, fundamental investors, so it is rare that we will invest in other investment vehicles, such as equity mutual funds or investment partnerships.

That said, there are times when significant investment opportunities present themselves, in which case we are both willing and able to take advantage of them. Pershing is one of them- it is the publicly listed investment vehicle for Bill Ackman’s famous activist hedge fund. Pershing’s investment philosophy is very similar to our own, they take a small number of concentrated positions in high quality, cash generative positions, however, they do so with an activist tilt- changing management/ strategy to drive returns. PSH is a slightly unusual case because Pershing is listed in London and Amsterdam as an investment trust, not a normal mutual fund.

One of the main implications of the investment trust structure is that the share price can be above or below the actual value of the underlying positions. Negative sentiment following a period of poor performance has pushed the share price down to around 70% of its intrinsic value. Management has been open and honest about past mistakes, and as such have re-positioned the portfolio, whilst also buying back 25% of the outstanding share capital, along with investing over $100m of their personal capital in the firm. Management now owns 20% of the outstanding shares, aligning their interests with that of the shareholders.

As management continues to buy back shares at such a discount and the story continues to gain more traction worldwide, we believe the unjustified discount will close. And even if it doesn’t in the coming months, the quality of the underlying investments here provides us with a significant margin of safety and growth potential.

BOOKING HOLDINGS

Booking Holdings is the largest online travel agency in the world, meaning they facilitate transactions between travelers and service providers such as hotels, vacation rentals, airlines, rental car services, restaurants, etc. Travelers win in this model through better pricing, greater selection, reliable reviews, and convivence. Service providers win through increased demand, which is very important considering the fixed costs associated with an empty hotel room.

The beauty of this model is that both sides reinforce each other in a network effect – more travelers means more suppliers, which means a better traveler experience, which means more travelers, which means even more suppliers. Along with that network effect, Booking Holdings benefits from a structural advantage due to its geographical dominance of the European market. The European hotel market is structured very differently than that here in the US. In Europe, the hotel marketplace is dominated by small independent boutique hotels, in the US the market is dominated by large chains such as Hilton or Marriot. The smaller European hotels are dependent on Booking Holdings to provide demand generation, marketing, customer support, website translation, payments, etc, thus reducing their bargaining power. This key difference between the European and US hotel marketplaces is the reason that Booking has such a strong position compared to the likes of Expedia who are heavily reliant on the US market; where the large hotel chains have more power and less need for an aggregator of room bookings. Once this fact is understood, it is easy to see why Booking consistently generates higher and more stable margins than Expedia and will continue to do so.

Going forward, Booking is well-positioned to benefit from the secular trend of increased global online travel spending. As global GDP continues to grow, poor countries continue to get richer, and newer generations of adults prioritize experiences over material goods, it is hard to see this trend reversing.

Disclosures: This website is for informational purposes only and does not constitute an offer to provide advisory or other services by Globescan in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction. The information contained on this website should not be construed as financial or investment advice on any subject matter and statements contained herein are the opinions of Globescan and are not to be construed as guarantees, warranties or predictions of future events, portfolio allocations, portfolio results, investment returns, or other outcomes. Viewers of this website should not assume that all recommendations will be profitable or that future investment and/or portfolio performance will be profitable or favorable. Globescan expressly disclaims all liability in respect to actions taken based on any or all of the information on this website.

There are links to third-party websites on the internet contained in this website. We provide these links because we believe these websites contain information that might be useful, interesting and or helpful to your professional activities. Globescan has no affiliation or agreement with any linked website. The fact that we provide links to these websites does not mean that we endorse the owner or operator of the respective website or any products or services offered through these sites. We cannot and do not review or endorse or approve the information in these websites, nor does Globescan warrant that a linked site will be free of computer viruses or other harmful code that can impact your computer or other web-access device. The linked sites are not under the control of Globescan, and we are not responsible for the contents of any linked site or any link contained in a linked site. By using this web site to search for or link to another site, you agree and understand that such use is at your own risk.