Second Quarter 2021 Update

GCI Select Equity Q2 2021

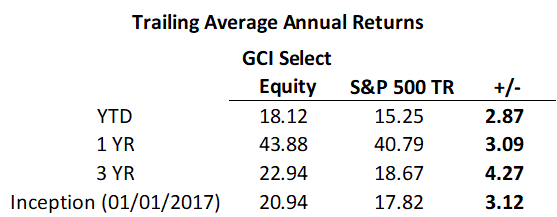

We are pleased to report another positive quarter in both absolute and relative terms. Our GCI Select Equity strategy ended the first half of 2021 up 18.1% gross of fees. For comparison, the S&P 500 ended up 15.3%:

Despite these continued positive results, you will likely have noticed that in a number of our recent articles we have been calling out why a prudent, long-term investment strategy such as our own, will at some point underperform the broader market for short periods. After all, if it did not then it wouldn’t be a prudent strategy – it would simply be taking ever-more risk to chase ever-lower returns.

We continue to make this point because we have begun to see pockets of irrational exuberance forming in asset markets. As we have seen these pockets emerge, our preferred strategy has been to simply avoid them, and instead focus on where we can find more defensible value for the long run.

As you know, Globescan Capital was founded on the principle that investing in high-quality companies at attractive prices is the most durable and consistent way to achieve long-run, risk-adjusted returns. As such, we will continue to do just that.

We’ve covered various topics in recent writings, and in this letter we’d like to spend some time discussing our largest equity position- a company that not only features heavily in the news but also one that is extremely closely followed by most market participants. We are often asked what our ‘edge’ could possibly be in a company such as this, so we would like to explain our thesis and our approach to it.

Facebook (FB)

Starting with the most recent events first, Facebook ended the quarter on a positive note after a federal court dismissed (for now) the FTC’s bid to unwind Instagram and WhatsApp from the company. From the Judge’s ruling:

“The FTC’s Complaint says almost nothing concrete on the key question of how much power Facebook actually had, and still has, in a properly defined antitrust product market. It is almost as if the agency expects the Court to simply nod to the conventional wisdom that Facebook is a monopolist. After all, no one who hears the title of the 2010 film “The Social Network” wonders which company it is about. Yet, whatever it may mean to the public, “monopoly power” is a term of art under federal law with a precise economic meaning: the power to profitably raise prices or exclude competition in a properly defined market. To merely allege that a defendant firm has somewhere over 60% share of an unusual, nonintuitive product market — the confines of which are only somewhat fleshed out and the players within which remain almost entirely unspecified — is not enough. The FTC has therefore fallen short of its pleading burden.”

In other words, the FTC failed to properly classify the market that Facebook supposedly dominates. In reality, Facebook’s advertising-based business model competes with all kinds of services that vie for consumer’s attention – video games, television, shopping platforms, messaging platforms; TikTok, Twitter, Snapchat, Netflix, Reddit, the list goes on. And they compete by creating better user experiences.

Nor was the FTC able to properly show the consumer harm resulting from Facebook’s offering – a service that we must remember is free to use for consumers. In fact, Facebook’s platform creates real value for society – on one side facilitating social connections, but perhaps more importantly on the other side empowering small businesses around the world to reach customers that would traditionally have been locked up by the large consumer brand companies. Facebook uses an auction model to price this business, ensuring these businesses pay only what the economics of their business can support.

Partly due to the positive outcome of this ruling, Facebook ended the quarter with a market cap in excess of $1T, a YTD return of 27%, and has now almost tripled in value from the 2018 lows.

Returning to the question: “What is our edge with a mega-cap company like Facebook? Surely, enough people are looking at it that it is priced efficiently?”.

At a headline level the answer to this question is simple – the market can and often does misprice companies of all sizes. During the same week that Facebook hit a $1T market cap, Microsoft Corporation (MSFT, another large holding for us) reached a $2T market cap, having also nearly tripled its value over the last three years. It is clear to us that, regardless of how many professional analysts are analyzing these companies, both stocks have been significantly mispriced in the past, and will continue to be at times in the future.

Let’s consider some reasons why:

Firstly, time horizon, which is coincidentally one of our biggest advantages as investors.

Overtime, the market and its participants have increasingly narrowed their focus on the short term, where price is mainly a function of supply and demand, which is ultimately influenced by short-term news flow and liquidity, not the underlying company itself.

Such a dynamic naturally leads to news flow having outsized influence on share prices rather than those prices being anchored to the ultimate value of the company. It is clear to us that due to a significant amount of political and regulatory pressure in the last few years, Facebook shares have suffered from a lot of negative market sentiment.

This negative sentiment depresses the short-term market price of a company like Facebook, and causes people to focus on the current risks, not the longer-term opportunities. Now while it is true that regulatory risks are real, it is not true that it is the most important variable to analyzing the investment opportunity in Facebook. It is a case of “missing the wood for the trees”.

As an aside, for anyone doubting that short term swings in market prices are not necessarily reflective of underlying company value, just look at the volatility of prices for any company of your choosing. It is quickly clear to even a casual observer that share prices move far more on an hourly, daily, weekly, and monthly basis than underlying company values could possibly change.

For example, if any of us were negotiating to buy a business privately, we would not need to update our offer price every single second during the negotiations because we all know the value of the company is not changing that rapidly. Sadly, the fact that prices are displayed and quoted every second leads most investors to the incorrect conclusion that the value of a company must also be changing at such a rate.

Secondly, the broad market is too focused on GAAP accounting, rather than on doing the difficult work of trying to understand the real underlying economics of these businesses.

Aside from the obvious fallacy of using past reported numbers to predict the future, we would argue that the current accounting standards do a poor job of accurately representing the true economic picture of many businesses today. One reason is the arguably inadequate treatment of intangibles by today’s accounting standards.

For example, Facebook is growing at a very high rate, and they are expensing (rather than capitalizing) significant investments made in coders, developers, etc. to build out platforms for which they will be able extract value from for years to come, but which they get no credit for today in their financials (Oculus, Shops, WhatsApp, etc).

Just consider that FB has 10k full-time engineers working on a VR/AR platform which generates losses today but will likely generate significant value in the future. The same is true with WhatsApp. Current accounting numbers do not properly account for the future value this company is creating today. Furthermore, nowhere in Facebook’s reported numbers do they account for their most valuable asset, the sheer depth and breadth of Facebooks global network of users, which they will likely be able to monetize in different ways going forward that just the sheer advertising model that we see in the numbers today.

In other words, the cash flows that Facebook is going to generate in 10 years’ time are likely to bear very little resemblance to the cash flow numbers generated in the last twelve months. And it’s those future cash flows that we as investors should focus on because that is what we’re buying. We aren’t buying the historic cashflows- they’ve been and gone. We are buying the right to participate in the future value generation of Facebook.

And the only way to understand what that future value generation could look like is to do an awful lot more work than just looking at historic numbers. This is such a fundamental investment concept, but one that is increasingly missed by so many market participants. People love using clever metrics and historic data to justify decisions, but it is very clear that such tools are not helpful when it comes to actually understanding which businesses are going to be the winners of the future.

This is a significant mistake made by much of the market and explicitly made by passive and factor- based investment strategies. if you’re trying to run a quantitative strategy, or factor-based strategy, there simply aren’t any available numbers or ‘factors’ that will accurately and reliably help you value a business such as Facebook. And we would argue the same is true for hundreds of businesses.

Thirdly, we would argue that prevailing valuation tools are not fit for purpose.

Take a second to consider the outdated measures many market participants use to assess ‘value’ in businesses. Without doubt, the most common is the PE (Price to Earnings) multiple, a deeply flawed metric we have written about many times. In a similar vein than using last year’s earnings to predict earnings 10 years out, is looking at the last 12 months of earnings really an appropriate way to value Facebook as a business? And think about other metrics, return on capital, book value, etc. Do any of these things really make much sense for a company like Facebook? It has little capital on its balance sheet, and therefore little technical book value. And as we’ve discussed, its past earnings don’t reflect the future potential, so using any form of earnings or EBITDA to value it clearly isn’t much help.

In our view, even after the recent runup, we still believe FB is a great value. Mark Zuckerberg has proven to be a masterful long-term capital allocator, and at only 37 years old he still has a long runway to continue building out his vision. Facebook still possesses the most wide ranging and simultaneously deep advertising platform in the world. This position is unassailable for many years, and as such it will continue to provide a fundamentally better advertising opportunity than any other medium available. And even if you really want to focus on the short term (and misleading) price multiple valuation metrics, when you adjust for cash on the balance sheet and the loss-making Oculus & WhatsApp segments, then the company does not appear expensive at all. And then on top of that, you basically get a free call option on their other segments that have the chance of becoming market leaders in VR, E-commerce, messaging, etc. This is how you can make money in mega-caps, by actually doing the work that the market will not.

What about the risks?

The way we see it, currently there are two main risks to owning Facebook: regulatory risk and reinvestment risk. Typically we try to avoid any form of regulatory risk- because regulations are political, and therefore not reliably forecastable. As a result, we are only going to own a company that has the political and regulatory headline risk of a Facebook if we are adequately being compensated for bearing that risk in terms of the price we can pay for the company. And with Facebook, we believe today’s valuation more than compensates us for that risk.

Our second concern is regarding reinvestment. With any high- quality company, we want to see the ability to not only produce significant cash flow, but also the ability to reinvest that cash at attractive rates. That is what separates the truly wonderful investments from average ones.

Even when we consider the huge investments Facebook is making into new (and often exciting) segments, Facebook has such a capital light model that they continue to generate cash faster than they can deploy it. Realistically, we have to assume that a lot of M&A is increasingly out of reach for the time being due to the current heightened regulatory concerns, so we would hope that Facebook starts considering other uses for their cash – ideally buying back more shares before the true value of the company is appreciated by the market.

All investments carry risk, and we continue to believe that despite its clear headline risks Facebook is not only one of the most influential and impressive companies of the last decade, but that it is also one of the most exciting and well placed for the next decade. And as is often the case, the market continues to provide us with fantastic opportunities to take advantage of that.

As always, we thank you all for partnering with us, and for your faith in us as stewards of your capital. Please feel free to reach out with any questions or comments you may have.

Disclosures: This website is for informational purposes only and does not constitute an offer to provide advisory or other services by Globescan in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction. The information contained on this website should not be construed as financial or investment advice on any subject matter and statements contained herein are the opinions of Globescan and are not to be construed as guarantees, warranties or predictions of future events, portfolio allocations, portfolio results, investment returns, or other outcomes. Viewers of this website should not assume that all recommendations will be profitable, or that future investment and/or portfolio performance will be profitable or favorable. Globescan expressly disclaims all liability in respect to actions taken based on any or all of the information on this website.

There are links to third-party websites on the internet contained in this website. We provide these links because we believe these websites contain information that might be useful, interesting and or helpful to your professional activities. Globescan has no affiliation or agreement with any linked website. The fact that we provide links to these websites does not mean that we endorse the owner or operator of the respective website or any products or services offered through these sites. We cannot and do not review or endorse or approve the information in these websites, nor does Globescan warrant that a linked site will be free of computer viruses or other harmful code that can impact your computer or other web-access device. The linked sites are not under the control of Globescan, and we are not responsible for the contents of any linked site or any link contained in a linked site. By using this web site to search for or link to another site, you agree and understand that such use is at your own risk.